- The Money Dad

- Posts

- How I Saved $10,000 by Treating My Budget Like a Game

How I Saved $10,000 by Treating My Budget Like a Game

Discover how I turned budgeting into a fun, competitive challenge—and saved $10,000 in the process. Learn practical, gamified strategies to take control of your money and actually enjoy managing it.

Impending Doom

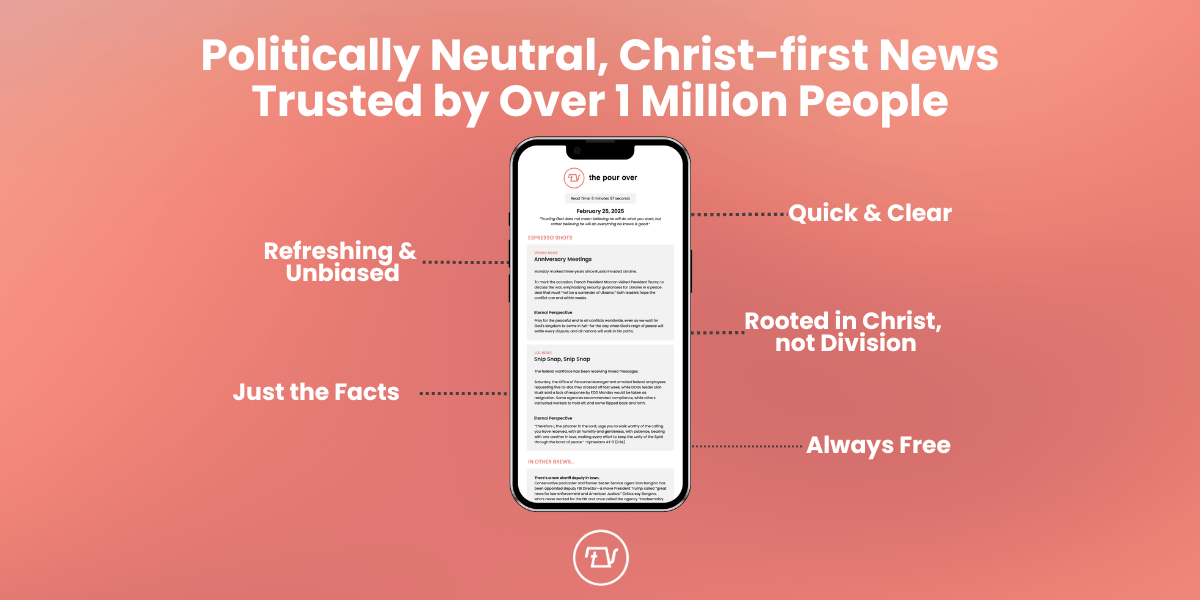

The Pour Over believes the news can be a force for good, helping people find rest and comfort in Christ while spurring them on to action.

Instead of, you know… creating division and a feeling of impending doom.

Join 1 million+ Christians who receive TPO’s politically-neutral, anger-and-anxiety-free, Christ-first news coverage.

Not long ago, my budget and I were like two coworkers who nodded politely in the hallway but actively avoided eye contact. Sure, I had a “budget” — a neatly color-coded spreadsheet I opened once a month, winced at, and immediately closed. But the truth? I treated budgeting like flossing: something I knew I should do but definitely wasn’t doing right.

That changed when I accidentally gamified my finances — and ended up saving $10,000 in a year.

Here’s how it happened (and how you can do it too).

Level 1: The Accidental “Game” That Started It All

It began on a Tuesday night, fueled by too much coffee and a mild existential crisis over my Amazon purchase history.

I decided to challenge myself: Could I go one whole week without spending money outside of bills and groceries?

Seven days. No coffee runs. No “but it’s on sale” excuses. No $2.99 apps I’d forget I owned.

Suddenly, it wasn’t just a budget. It was a mission. A stealth operation. A game.

Spoiler: I survived the week. Barely. But that little challenge flipped a switch in my brain. Tracking spending became less about restriction and more about winning.

Level 2: Setting Up the Rules (Because Every Good Game Needs Them)

Once I realized my competitive side could work for me, I leaned in. Hard.

Here’s how I set up the “game board” for my budget:

Daily Points System: Every day I stayed under budget, I earned points. Overspend? Lose points. Bonus Challenges: Extra points for things like cooking all meals at home for a week or selling something I didn’t use. Boss Levels: Big challenges like “No-Spend November” or negotiating down a monthly bill.

Instead of feeling guilty when I spent money, I started thinking:

“Is this purchase worth losing points?”

(Answer: It’s rarely worth it for a fourth phone charger.)

Level 3: Unlocking Achievements (And Real-Life Dollars)

Saving became… fun?

I know. I don’t believe it either.

As the months went by, I set bigger milestones:

Hit $500 saved? Unlock a night out. Hit $2,000? Treat myself to something small and guilt-free. Hit $10,000? Throw a mini celebration (and yes, budget for it).

By treating milestones like “achievements,” I kept the momentum going. I wasn’t just surviving a budget — I was leveling up my financial life.

Level 4: Boss Strategies for Your Budget Game

If you’re thinking about gamifying your budget, here’s what I learned:

Set Short-Term Wins: Don’t just budget for the month. Set weekly goals you can hit. Small wins keep you motivated. Track Progress Visibly Use a whiteboard, an app, a sticker chart — whatever gives you that satisfying checkmark feeling. Compete (Even If It’s Just With Yourself). Try to beat your “high score” every month. More saved = new record. Reward Yourself — But Budget for IT. Give yourself a little prize when you hit a goal. Just make sure it fits inside the budget. (Sorry, no Tesla-for-saving-$200 situations.) Make It Personal: Customize your challenges. Hate cooking? Maybe your challenge is packing lunch twice a week instead of every day. It has to feel achievable and slightly daring.

Final Level: Why This Worked

Gamifying my budget took something that used to feel heavy and turned it into something I looked forward to.

Instead of seeing limits, I saw opportunities to “win.”

Instead of guilt, I felt proud.

And instead of wondering where my money went every month, I watched it pile up — $10,000 at a time.

And now, when I open my spreadsheet, it doesn’t give me heart palpitations.

It gives me a high score.

We’re excited to announce The Money Dad Referral Program! Share your unique link with friends and family, and earn exclusive rewards like our Creative Tax Strategies for W2 Employees guide, coaching calls, and more as a thank-you for helping grow our community.