- The Money Dad

- Posts

- How to Create a Family Budget for the New Year

How to Create a Family Budget for the New Year

Let’s face it—there’s nothing quite like ringing in the new year with a shiny resolution to “spend less and save more,” only to blow your entire budget on discounted gym equipment by January 5th. Don’t worry—you’re not alone. Family budgeting isn’t just for math wizards or spreadsheet enthusiasts; it’s for anyone who wants to stop asking, “Where did all our money go?”

This guide will show you how to create a family budget that sticks (without requiring a degree in finance or black-belt-level discipline). Let’s get to it!

Step 1: Gather the Troops

Budgeting is a family affair, not a solo mission. Call a family meeting—yes, even the kids. Turn it into a pizza night to keep everyone happy and distracted from the fact that they’re about to discuss…money.

Lay it out simply:

• What’s a budget? (Spoiler: Not a punishment.)

• Why does it matter? (Hint: More money for things like vacations or that dream hockey stick!)

• What are the family goals? (New car? College savings? Fewer arguments over spending?)

Step 2: Find Out Where You Stand

It’s time for the cold, hard truth: where does your money go?

• Step 2A: Write down your income.

This includes salaries, side hustles, and that jar of “spare change” the kids raid for the ice cream truck.

• Step 2B: Track expenses.

Go through your bank statements like a detective on a mission. Look for the usual suspects: groceries, utilities, subscriptions, and the sneaky “Oh, I just needed one more thing from Amazon.”

Pro Tip: There’s no shame in realizing your coffee shop habit costs more than your water bill. Awareness is the first step!

Step 3: Divide and Conquer

Break your spending into categories:

1. Essentials: Rent/mortgage, utilities, food.

2. Savings: Emergency fund, retirement, college.

3. Fun: Hobbies, entertainment, family outings.

Give every dollar a job. If your budget were a family road trip, this step is the GPS—you’re deciding where everything goes to avoid getting “lost” mid-month.

Step 4: Set Realistic Goals

Remember that time you vowed to save $10,000 in six months but still splurged on takeout every weekend? Yeah, me too.

Start with small, achievable goals, like:

• Save $500 for an emergency fund.

• Cut back on eating out by 25%.

• Save $50/month for next year’s holiday gifts.

Step 5: Use Tools That Make Budgeting Fun (Yes, Fun!)

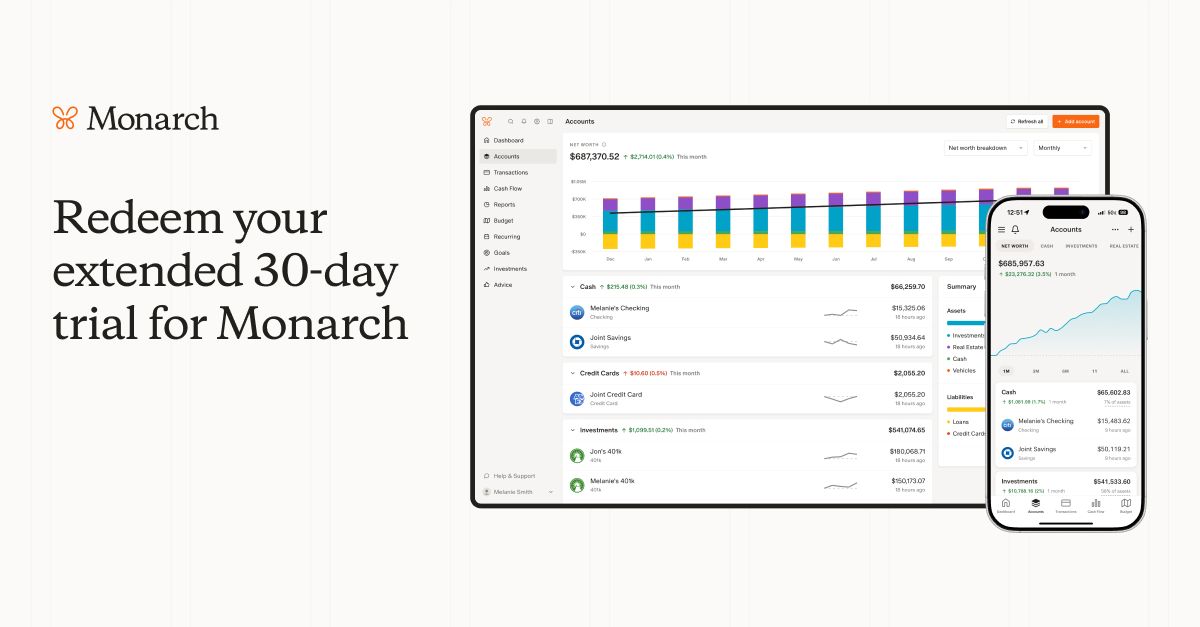

Budgeting apps like YNAB or EveryDollar can make managing your finances feel like a game. Prefer the old-school route? Create a colorful spreadsheet or a giant family goal tracker and stick it on the fridge. (Nothing motivates kids like gold star stickers.)

Step 6: Check In and Adjust

Your budget isn’t a “set it and forget it” plan. Schedule monthly family check-ins to see how you’re doing. Celebrate wins (movie night!) and tweak what’s not working. Did grocery costs spike? Adjust another category to stay on track.

Step 7: Don’t Forget to Have Fun

A family budget isn’t about sacrificing joy—it’s about making sure your spending aligns with your values. So, include a little wiggle room for treats, surprises, and guilt-free splurges.

Final Thought:

Creating a family budget for the new year doesn’t have to feel like a chore. When done right, it’s empowering, collaborative, and even a little fun. So grab your calculators (or pizza) and start planning a financial future that works for your whole family.

Cheers to a year of saving smarter, spending better, and maybe even affording that dream family vacation!

What are your family’s top financial goals for the year? Share them in the comments below—I’d love to hear your plans!

We’re excited to announce The Money Dad Referral Program! Share your unique link with friends and family, and earn exclusive rewards like our Creative Tax Strategies for W2 Employees guide, coaching calls, and more as a thank-you for helping grow our community.