- The Money Dad

- Posts

- The #1 Tax Move Most Families Forget Before the School Year Starts

The #1 Tax Move Most Families Forget Before the School Year Starts

Discover the #1 tax move most families forget before the school year starts—funding a 529 college savings plan. Learn how to cut your tax bill, maximize state deductions, and grow your child’s college fund faster.

Ready to get your team on the same page?

When workplace comms are clear and concise, you cut out:

Endless back-and-forths

Confusion and misalignment

Time-consuming follow-ups

Get — or give — the workbook that shows you how to be more succinct.

The #1 thing you can do to support me? If you open this email, please take a second to click the 'Axios' ad above — just clicking the link (no purchase needed) helps me out in a big way.

Back-to-school season hits hard. New sneakers, backpacks, endless supply lists, sports fees, music lessons—it feels like you’re swiping your card every five minutes. Most families just grit their teeth and get through it, hoping the credit card bill won’t sting too much.

But here’s the thing: there’s a smart tax move almost every family forgets right before the school year kicks off. And if you do it now, it can save you hundreds—even thousands—when April rolls around.

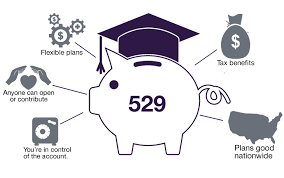

The Move: Fund Your 529 College Savings Plan Now

Most parents know about 529 college savings plans, but few realize they can be a double win:

You’re investing for your kid’s future tuition.

You may get a state tax deduction or credit this year for contributions.

That means all the money you’re already planning to spend on your child’s education in the future (college tuition, books, even room and board) could be earning you a tax break today.

Why Back-to-School Is the Perfect Time

Here’s why timing matters:

Cash Flow Awareness – You’re already thinking about school-related costs, so it’s the perfect mental trigger to put money aside for future education.

State Tax Year Deadline – Many states let you claim deductions for contributions made by December 31st. Starting now spreads out the funding over the next few months instead of scrambling at year-end.

Compound Growth – Every dollar invested earlier has more time to grow tax-free before your child heads to college.

Think of it like this: Would you rather put $1,000 into a fund that works for you for 10 years, or wait until the last minute and lose that decade of growth?

Example: The Quick Win

Let’s say you live in a state that gives you a deduction for 529 contributions.

You put $2,500 into a 529 this September.

Your state allows you to deduct that from your income.

At a 5% state tax rate, that’s $125 back on your taxes—just for moving money into the right account.

Now imagine you do that year after year. That’s hundreds of dollars back, plus years of tax-free growth.

How to Take Action This Week

Check your state rules. Not every state gives a deduction, but many do. (Some even give credits, which are even better.)

Open or log into your 529 account. If you don’t have one, it takes less than 15 minutes to set up.

Set a back-to-school tradition. Every September, when the kids go back, make a contribution. It becomes as routine as buying notebooks.

Final Thought

Most families think about saving for college only when a big milestone hits—like the first tuition bill. By then, it’s too late to reap years of growth and tax savings.

But if you make this one tax move before the school year starts, you’ll:

lower your tax bill,

grow a college fund faster,

and set your kids up for a future without crushing debt.

That’s the kind of money-smart parenting that pays off—literally.

👉 Want to learn more about strategies like this? Join my Money Dad newsletter, where I share practical, family-focused financial moves every week.

BOOK A DISCOVER CALL: Let’s see if it makes sense to work together

We’re excited to announce The Money Dad Referral Program! Share your unique link with friends and family, and earn exclusive rewards like our Creative Tax Strategies for W2 Employees guide, coaching calls, and more as a thank-you for helping grow our community.